Smart Ag Land Buyers Don’t Leave Deductions in the Dirt.

Every acre you buy with extra nutrients carries a hidden tax deduction.

Soil Tax Guys specializes in IRS Section 180. It’s all we do.

With transparent math, CPA-ready reports, and case studies from land buyers like you.

Your land pays you back.

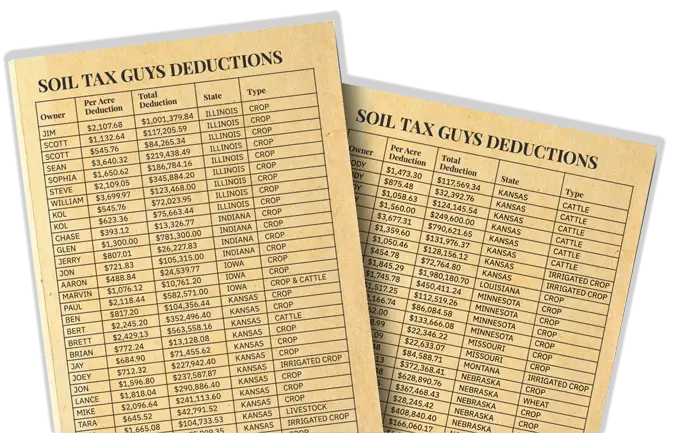

Soil Tax Guys Deductions ◢

Owner | Per Acre Deduction | Total Deduction | State | Type |

Avery | $679.42 | $62,296.02 | Arkansas | Crop |

Mani | $908.14 | $1,194,567.36 | California | Almonds |

Melissa | $862.42 | $176,364.89 | California | Vineyard |

Dan | $2,593.88 | $189,405.12 | Colorado | Cattle |

Dan | $1,050.00 | $179,550.00 | Colorado | Irrigated Crop |

Monty | $2,641.38 | $433,978.73 | Colorado | Irrigated Crop |

Danny | $563.22 | $132,356.70 | Georgia | Crop |

Danny | $563.22 | $82,782.08 | Georgia | Crop |

Austin | $4,693.16 | $406,896.97 | Illinois | Crop |

Bob | $817.20 | $70,769.52 | Illinois | Crop |

Brad | $1,491.02 | $62,831.58 | Illinois | Crop |

Brian | $359.68 | $41,352.41 | Illinois | Crop |

Carter | $2,738.98 | $27,389.80 | Illinois | Crop |

Gary | $505.89 | $35,574.18 | Illinois | Crop |

Gary | $869.76 | $57,508.53 | Illinois | Crop |

Gary | $386.19 | $26,681.87 | Illinois | Crop |

Ingrum | $429.66 | $66,803.54 | Illinois | Crop |

Jeff | $2,536.00 | $935,530.40 | Illinois | Crop |

Jim | $2,107.68 | $1,001,379.84 | Illinois | Crop |

Scott | $1,132.64 | $117,205.59 | Illinois | Crop |

Scott | $545.76 | $84,265.34 | Illinois | Crop |

Sean | $3,640.32 | $219,438.49 | Illinois | Crop |

Sophia | $1,650.62 | $186,784.16 | Illinois | Crop |

Steve | $2,109.05 | $345,884.20 | Illinois | Crop |

William | $3,699.97 | $123,468.00 | Illinois | Crop |

Kol | $545.76 | $72,023.95 | Illinois | Crop |

Kol | $623.36 | $75,663.44 | Illinois | Crop |

Chase | $393.12 | $13,326.77 | Indiana | Crop |

Glen | $1,300.00 | $781,300.00 | Indiana | Crop |

Jerry | $807.01 | $26,227.83 | Indiana | Crop |

Jon | $721.83 | $105,315.00 | Indiana | Crop |

Aaron | $488.84 | $24,539.77 | Iowa | Crop |

Marvin | $1,076.12 | $10,761.20 | Iowa | Crop |

Paul | $2,118.44 | $582,571.00 | Iowa | Crop and Cattle |

Ben | $817.20 | $104,356.44 | Kansas | Crop |

Bert | $2,245.20 | $352,496.40 | Kansas | Crop |

Brett | $2,429.13 | $563,558.16 | Kansas | Cattle |

Brian | $772.24 | $13,128.08 | Kansas | Crop |

Jay | $684.90 | $71,455.62 | Kansas | Crop |

Joey | $712.32 | $227,942.40 | Kansas | Crop |

Jon | $1,596.80 | $237,587.87 | Kansas | Irrigated Crop |

Lance | $1,818.04 | $290,886.40 | Kansas | Crop |

Mike | $2,096.64 | $241,113.60 | Kansas | Crop |

Tara | $645.52 | $42,791.52 | Kansas | Crop |

Tom | $1,665.08 | $104,733.53 | Kansas | Livestock |

Tyler | $2,409.48 | $375,999.35 | Kansas | Irrigated Crop |

Wade | $854.04 | $33,401.50 | Kansas | Crop |

Walt | $1,812.94 | $165,249.48 | Kansas | Irrigated Crop |

William | $1,909.04 | $229,084.80 | Kansas | Crop |

William | $1,480.24 | $229,437.20 | Kansas | Crop |

William | $1,433.84 | $172,060.80 | Kansas | Crop |

Cody | $2,020.96 | $4,957,414.88 | Kansas | Cattle |

Cody | $1,473.30 | $117,569.34 | Kansas | Cattle |

Cody | $875.48 | $32,392.76 | Kansas | Cattle |

Cody | $1,058.63 | $124,145.54 | Kansas | Cattle |

Cody | $1,560.00 | $249,600.00 | Kansas | Cattle |

Cody | $3,677.31 | $790,621.65 | Kansas | Cattle |

Jamie | $1,359.60 | $131,976.37 | Kansas | Cattle |

Paul | $1,050.46 | $128,156.12 | Kansas | Irrigated Crop |

Paul | $454.78 | $72,764.80 | Kansas | Irrigated Crop |

Bruce | $1,845.29 | $1,980,180.70 | Louisiana | Crop |

Ben | $1,745.78 | $450,411.24 | Minnesota | Crop |

Chris | $1,517.25 | $112,519.26 | Minnesota | Crop |

Luke | $2,166.74 | $86,084.58 | Minnesota | Crop |

Steve | $562.00 | $133,666.08 | Minnesota | Crop |

Jayne | $338.99 | $22,346.22 | Missouri | Crop |

Jayne | $1,117.12 | $87,492.84 | Missouri | Crop |

Keegan | $436.09 | $22,633.07 | Missouri | Crop |

Colby | $774.48 | $84,588.71 | Montana | Irrigated Crop |

Eddie | $2,387.13 | $372,368.41 | Nebraska | Crop |

Eddie | $2,004.88 | $628,890.76 | Nebraska | Wheat |

Jason | $1,231.05 | $367,468.43 | Nebraska | Crop |

Michael | $695.70 | $28,245.42 | Nebraska | Crop |

Paula | $1,318.84 | $408,840.40 | Nebraska | Crop |

Joshua | $758.82 | $166,060.17 | North Dakota | Crop |

Ronda | $2,729.22 | $6,028,683.23 | North Dakota | Crop |

Ronda | $800.00 | $496,000.00 | North Dakota | Crop |

Ronnie | $692.55 | $16,150.27 | Ohio | Crop |

Cale | $446.70 | $24,090.53 | Oklahoma | Cattle |

Mario | $685.84 | $68,241.08 | Oklahoma | Livestock |

Raylon | $2,500.00 | $400,000.00 | Oklahoma | Cattle |

Wayne | $1,284.92 | $220,620.76 | Oklahoma | Cattle |

Troy | $579.92 | $8,866.98 | Pennsylvania | Crop |

Mark | $715.26 | $30,827.71 | South Dakota | Cattle |

Steve | $580.27 | $28,607.31 | Tennessee | Crop |

Steve | $1,751.57 | $719,194.64 | Tennessee | Crop |

Matt | $1,995.00 | $1,038,597.00 | Texas | Peanuts |

Steve | $701.54 | $65,018.73 | Texas | Cattle |

Ted | $653.50 | $55,286.10 | Texas | Crop |

Many Ag Land Buyers are Doing It.

Your Investment: $40/acre

Average Return on Investment: $500/acre tax deduction value.

Example: 1,000 acres = $500,000 estimated tax deduction

Timing Matters.

IRS Section 180 must be claimed after closing, but before you apply fertilizer. Once you fertilize, the deduction is gone forever.

That’s why smart land buyers check eligibility right after closing. And why you should too.

Don’t leave six and seven figure deductions buried in the soil.

Documented Data.

CPA Ready.

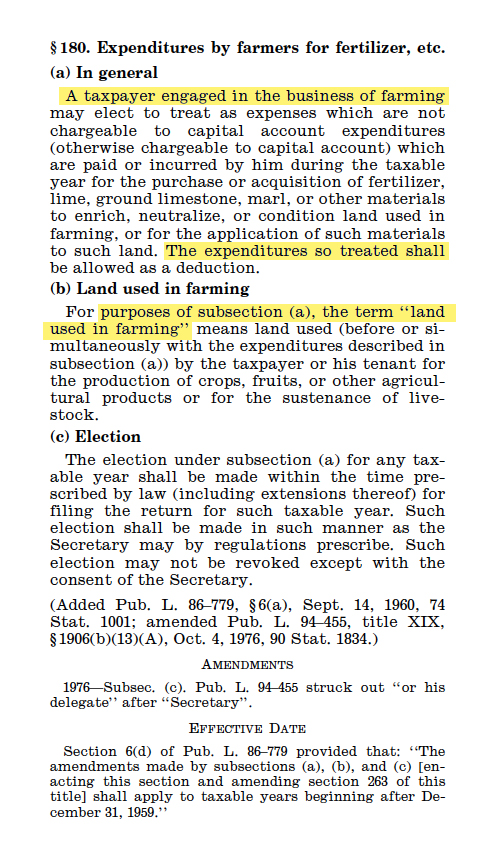

IRS Section 180

Science Backed.

Every report we deliver is built to withstand IRS scrutiny. Your CPA gets full, transparent documentation. Nothing hidden, nothing gray.

You got documentation. It’s with the purchase of land. Here’s section 180. This is why we did it. Oh, okay. And then they can’t really argue with it, because there’s nothing really to argue about. It’s not like I make up a number. If you got a guy like Alec to value it and give you the documentation to say, here’s the value. Okay, what am I going to argue about?

-Russ, CPA

IRS Section 180

Through soil testing and

Section 180 tax expertise, we turn soil

nutrients into real financial returns

empowering land buyers to build lasting,

generational wealth from the ground they

work every day.

Backed by Science, built for CPAs, strict to the IRS Section 180 code.

Your soil holds value. Not theory, truth. The numbers are buried deep, and we know where to dig. This isn’t about fancy suits or flashy talk. It’s about turning your grit into gain, with a little help from IRS Section 180 and a team that speaks your language: dirt, data, and damn good strategy.

We Specialize in Section 180, Soil Tax Deductions

We believe in a

conservative approach

rooted in science that

will produce the most

accurate values for

these deductions.

Alec Bean C.C.A.

Owner of the Soil Tax Guys

Agronomist

Certified Crop Advisor

Affiliated with the

American Society

of Agronomy

Curious If

You Qualify?

You’re not alone.

Dozens of ag land buyers reach out every month.